Marketing automation is an indispensable tool for financial institutions. It is the doorway to scaling your meaningful ...

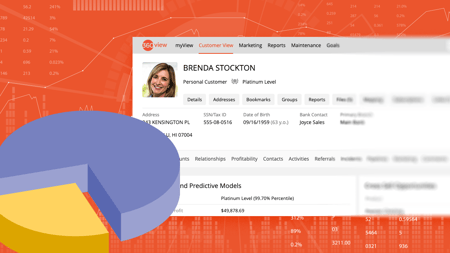

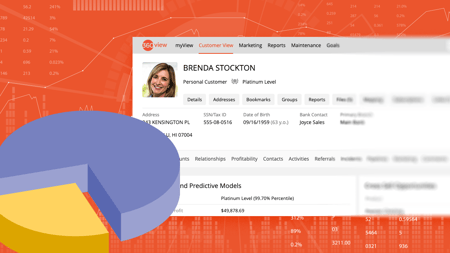

As a collective of former bankers, our team at 360 View understands the decision involved in integrating a CRM system ...

Re-engaging dormant customers is a profit-making engine you don't want to ignore The engine that takes you nowhere is ...

Humanizing Digital Customer Experience: A Blueprint for Success In times of crisis, priorities shift. If you've ...

Unearth Your Data Goldmine: The Power of Data in Financial Institutions In 1849, M.F. Stephenson exclaimed, “There’s ...

As we look forward to 2024, the financial landscape continues to evolve, driven by technological advancements and ...